[ad_1]

After the market closes on Wednesday, Nvidia will report earnings for the first quarter of its fiscal year 2026, which ended on April 27.

While many in the industry are likely eager to hear how the recent whiplash surrounding U.S. chip export controls will impact Nvidia’s international chip business and future guidance, not everyone thinks that is the most important piece of Nvidia’s results to pay attention to.

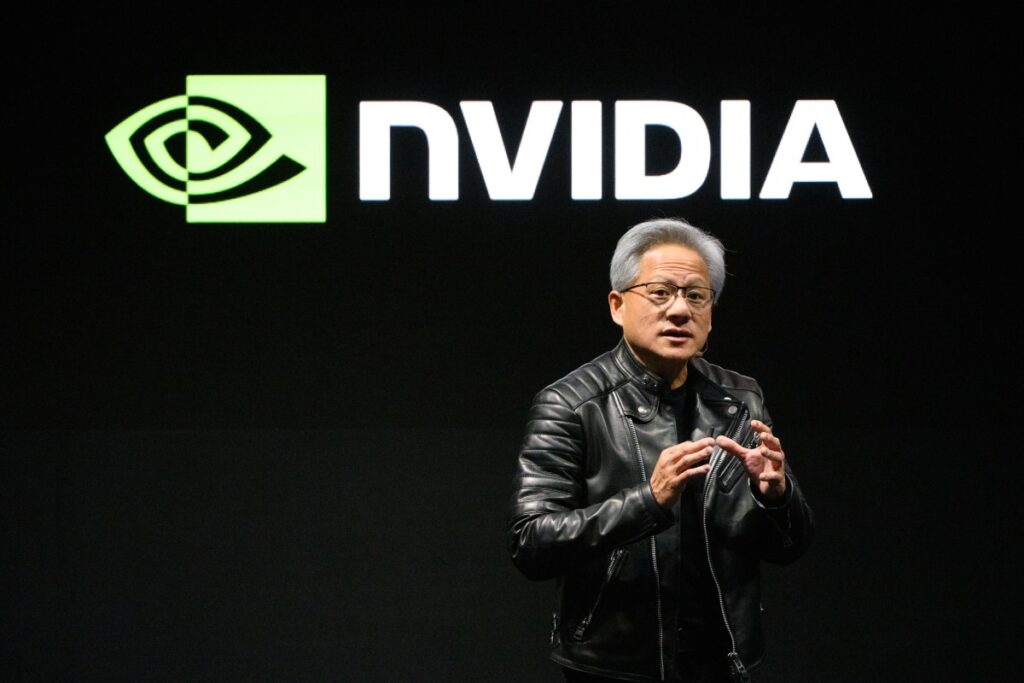

Kevin Cook, a senior equity strategist at Zacks Investment Research who has followed Nvidia for a decade, told TechCrunch he believes the company’s rollout of its new GB200 NVL72 hardware — a single-rack exascale computer that started shipping in February — is a much more important area for shareholders to focus on.

These GB200 NVL72 machines include 72 GPUs and cost around $3 million. Cook said that, despite strong demand and high expectations heading into this year, the chaos around DeepSeek in late January sparked many analysts to halve their delivery estimates for the unit.

Cook added that, because this is the first quarter the company has shipped the machine, there isn’t yet a clear indicator of how things are going.

“If Jensen [Huang] says we are going to deliver 10,000 units in Q2, the street will be very impressed,” Cook said. “That’s a big doable number; 10,000 is $30 billion on a $3 million product. I think they are going to do less than 5,000.”

Cook added that these results will start to paint a picture of enterprise appetite for the latest AI tech. Will companies upgrade their AI hardware each time a new system comes out, similar to how consumers upgrade to the latest iPhone each year? Cook isn’t sure. Whether or not enterprises will adopt that behavior could have a significant impact on Nvidia down the line.

There will be immediate effects on Nvidia’s stock based on what the company says regarding U.S. export controls, Cook predicted. But he doesn’t think it will impact Nvidia’s valuation or stock price long term in the same way that demand for the GB200 NVL72 might.

Nvidia’s stock price has proven it can recover from short-term market reactions, he added.

“We basically had a flash crash, and it’s right back up,” Cook said regarding Nvidia’s stock price after the chip export restrictions were announced. “That’s unique to Nvidia. Lots of companies are going to have hiccups, but Nvidia has the biggest moat. They have the most resilience to any of this. It’s such an irony that they could have this issue with China — whether or not they can sell — and it basically gets shrugged off, right?”

Even if chip export restrictions on China remain or become more stringent, Cook argued that Nvidia isn’t struggling to find customers elsewhere. The company currently sells to all the major hyperscalers and will likely continue to see strong demand for its AI chips. He added that the recent announcements regarding Stargate’s new project in the Middle East will likely be another win for the company.

For Cook, his guidance really comes down to those GB200 NVL72 units.

“As long as we hear that deliveries are expected to be steady to exceptional, then whatever fluctuations in this quarter’s revenue, I think, are going to be put on the back burner because the wind is in their sails for the rest of the year,” Cook said.

[ad_2]

Source link