[ad_1]

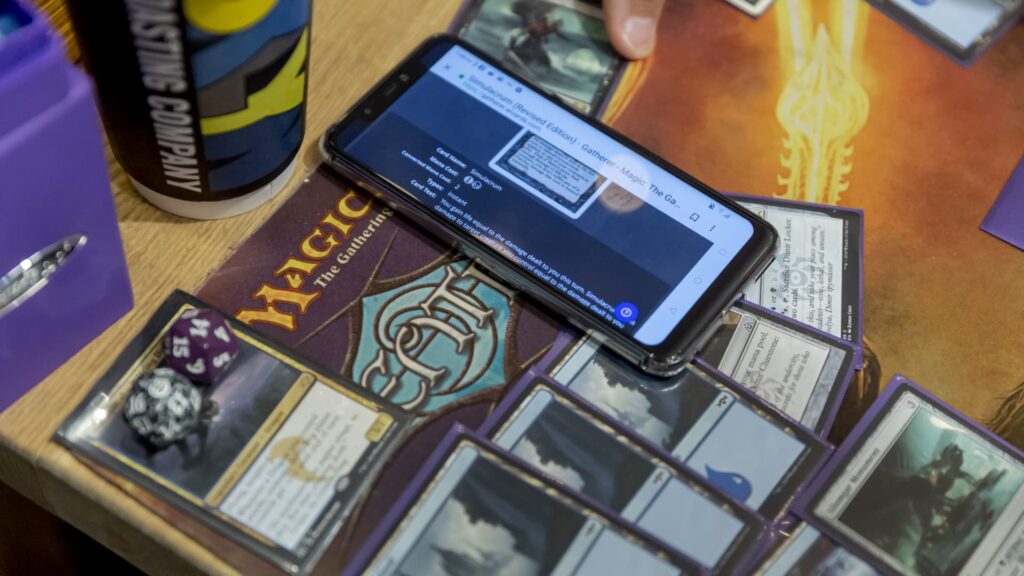

The strength of Hasbro’s gaming portfolio is being overlooked by investors, according to Goldman Sachs. Analyst Stephen Laszczyk upgraded shares of the toymaker to buy from neutral and lifted his 12-month price target by $19 to $85. That suggests the stock could jump about 15.1% from Monday’s close. “We believe Hasbro is well-positioned to exceed consensus expectations in 2026+ across revenue, adjusted EBITDA, and free cash flow,” Laszczyk wrote in a Monday note to clients. He added that his 17.5x target price-to-earnings multiple is in line with where other scaled video game and digital media companies trade. The analyst’s pointed to three factors driving his upgrade and price target hike: Magic: The Gathering’s new Universes Beyond sets, which include card designs from Fortnite, Dungeons & Dragons and Marvel properties The company’s self-published digital gaming strategy “Better-than-feared” performance from the toy business as tariff relief, market share growth and pricing insulate profitability HAS 1Y line Hasbro stock performance over the past year. Key to Laszczyk’s investment thesis for Hasbro are his growth expectations for Wizards of the Coast (WOTC), which he expects to contribute the majority of Hasbro’s EBITDA going forward as the company leans into digital gaming. He forecasts WOTC’s revenue will see roughly 7% compound annual growth over the next five years — from $1.755 billion in 2025 to $2.454 billion in 2030. “We believe that long-term execution opportunities in the WOTC segment are underappreciated by the market, while near-term macro risks to profitability in the Consumer Products segment are overstated (as discussed within),” Laszczyk said. “As a result, we believe that shares currently offer investors an attractive risk-reward skew with a robust catalyst path over the next ~12 months.” Laszczyk sees upside overall being driven by Hasbro’s self-publishing games business, which he believes can contribute between $150 million and $300 million in revenue per game, or roughly $450 million annually, over the next 5 years. According to the analyst, Magic the Gathering will be Hasbro’s first $1 billion brand driven by higher player volume, spend per player and increased app engagement. Hasbro is also a durable play compared to its peers, according to Laszczyk. “Hasbro benefits from a portfolio of strong IP (e.g., Transformers, Marvel, Monopoly, Magic The Gathering) and from one of the most flexible & strongest supply chains in the toy industry,” he said. “Given these characteristics, we see Hasbro’s significant scale as a key factor insulating the company from broader weakness in industry supply/demand.” Hasbro shares rose nearly 2% in the premarket. Shares have been on fire this year, soaring 32% in that time.

[ad_2]

Source link