[ad_1]

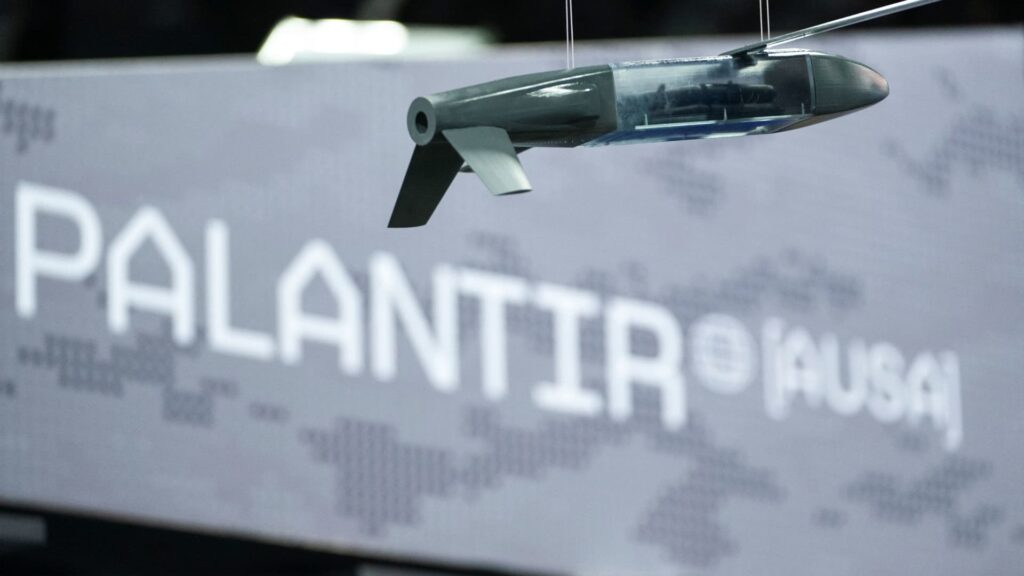

Palantir and Constellation Energy are buys that will benefit from the rise in artificial intelligence, while Salesforce faces rising competition in workflow software, according to David Kudla, founder and CEO at Mainstay Capital Management. Kudla joined CNBC’s “Power Lunch” to discuss his views on the three stocks. Palantir Palantir , which has outperformed its peers after surging 64% in 2025, is still a buying opportunity for investors looking to tap into government demand for the company’s AI-enabled tools. “We still think Palantir is a buy. Probably a buy on the dips,” said Kudla, who added that he bought the stock in June 2023 when it was trading at around $15 a share. It was last selling for about $124 per share. PLTR 1D mountain Palantir “They are leveraging AI very well, they’re winning the space with AI on counterterrorism and what they’re doing for governments and they’re increasing their commercial contracts in the private sector,” Kudla said. “So, we think this stock has a lot further to run, even though it’s richly valued.” Constellation Energy Constellation Energy , the largest nuclear operator in the U.S. , is a clear beneficiary of the government’s support of nuclear power after President Donald Trump last week signed executive orders to overhaul the Nuclear Regulatory Commission, Kudla said. “Clearly, they are a winner going forward,” Kudla said. “Those executive orders are to help with deregulation, and the nuclear industry, where it’s redundant, where it can be streamlined. It takes almost 10 years to build a nuclear plant right now, and the idea here with the energy demands for AI data centers is to let nuclear grow and provide the energy that America needs.” The investor added that he bought the stock at the end of March. It’s surged 38% just in May. Salesforce Salesforce is a hold, according to Kudla, who said the enterprise software company faces stiff competition from Microsoft . “We’re not as excited about Salesforce at this point,” Kudla said. “About 7% year over year growth, still a leader, still a leader in its space. But, you know, as AI is disrupting every industry, it’s doing that in CRM and workflow software as well.” “We have the wars between Microsoft Copilot and Salesforce Agentforce, who’s going to win the battle, with back and forth,” Kudla added. “But it’s really about integrating AI into what they do, and who’s going to do that the best.” The stock is down more than 17% year to date through the Wednesday close, and trading about 1.6% postmarket following better-than-expected fiscal first-quarter results and improved forward guidance.

[ad_2]

Source link