[ad_1]

New York

CNN

—

Nvidia missed out on $2.5 billion in additional revenue during the first quarter of this year because it had to stop shipping its H20 artificial intelligence chips to China after the Trump administration instituted fresh export restrictions last month.

Despite those unearned sales — revealed in the company’s earnings report Wednesday — Nvidia took a smaller blow from the new H20 restrictions during the quarter than expected. It took a $4.5 billion charge in the quarter associated with excess H20 inventory and purchase obligations it couldn’t fill because of the export controls, although it had warned investors last month the hit might be as high as $5.5 billion.

Investors had been watching the impact of the H20 export controls because they underscore Nvidia’s increasingly tenuous position at the center of an increasing US-China trade and tech war. The smaller than expected charge is likely to be viewed as a positive sign, although the company added it expects to lose out on another $8 billion in revenue during the second quarter because of the H20 controls.

Nvidia’s shares rose 3.5% in after-hours trading following the report.

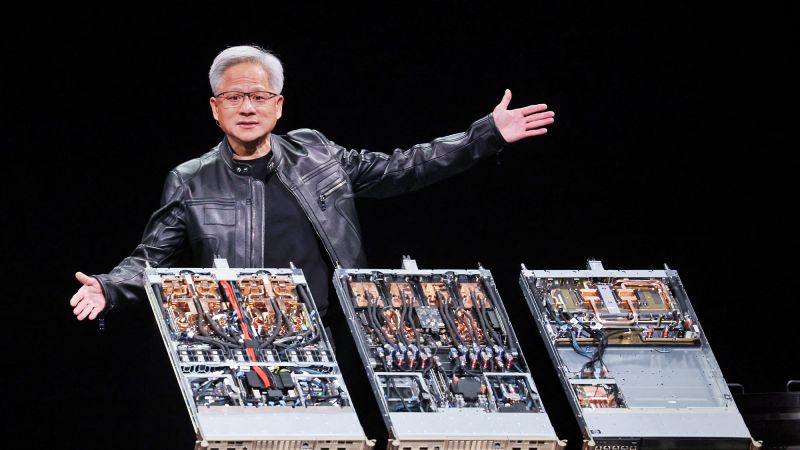

Nvidia last year released the H20 chip to accommodate stringent US export controls to China while maintaining access to the market, which accounted for around 13% of its sales last year. But in April, the White House told the company it would need a special license to export the H20 — which is widely believed to have contributed to the powerful Chinese AI model DeepSeek — to China. Nvidia CEO Jensen Huang has called US chip export controls a “failure.”

Huang told analysts on a call Wednesday evening that Nvidia is exploring how else it can compete in China, but reiterated his opposition to the export controls.

“China’s AI moves on with or without us,” he said. “The question is not whether China will have AI — it already does — the question is whether one of the world’s largest AI markets will run on American platforms.”

He added that shielding Chinese tech companies from American technology “only strengthens” foreign rivals and “weakens America’s position.”

But despite the uncertainty caused by the White House’s trade policy, Nvidia’s overall business continues to grow at a striking clip.

The chipmaker exceeded Wall Street analysts’ expectations for both revenue and profits during the first quarter. It earned $44.1 billion in revenue, up 69% from the same period in the prior year. And its net income grew 26% year-over-year to $18.8 billion.

“Even during a period of industry consolidation — with growing competition and geopolitical tensions creating a more challenging macro environment — the company demonstrated its ability to focus on the right operational areas,” Thomas Monteiro, senior analyst at Investing.com, said in emailed commentary. He added that the smaller than expected impact from the H20 controls “highlighted Nvidia’s adaptability to changing market conditions.”

Given its central role building many of the chips that power AI systems, Nvidia’s earnings are viewed as a barometer for the larger tech sector. Uncertainty around tariffs and trade policy, as well as tough questions from investors about returns on AI spending, have loomed over the industry.

Huang said in a statement Wednesday that demand for the company’s AI technology remains “incredibly strong.”

The company is benefitting from a growing use of major AI services — such as those offered by OpenAI, Google and Microsoft — generating demand for AI infrastructure and chips, executives said on Wednesday’s call. Investments by governments in so-called sovereign AI projects are also contributing to higher demand for Nvidia’s chips.

The United States and United Arab Emirates announced earlier this month a partnership to build a massive data center complex in Abu Dhabi to advance AI capabilities with 5-gigawatts of capacity. The project, which will mark the largest data center system outside the United States, was announced during US President Donald Trump’s visit to the UAE. Huang was also present during the visit.

Huang also touched on Trump’s effort to convince tech companies to move more of their manufacturing — especially semiconductor production — to the United States, with the chief executive saying he shares the president’s vision.

Last month, the company announced plans to partner with manufacturing companies to build factories in Texas to produce AI chips and supercomputers.

–This story has been updated with additional context and details.

[ad_2]

Source link