[ad_1]

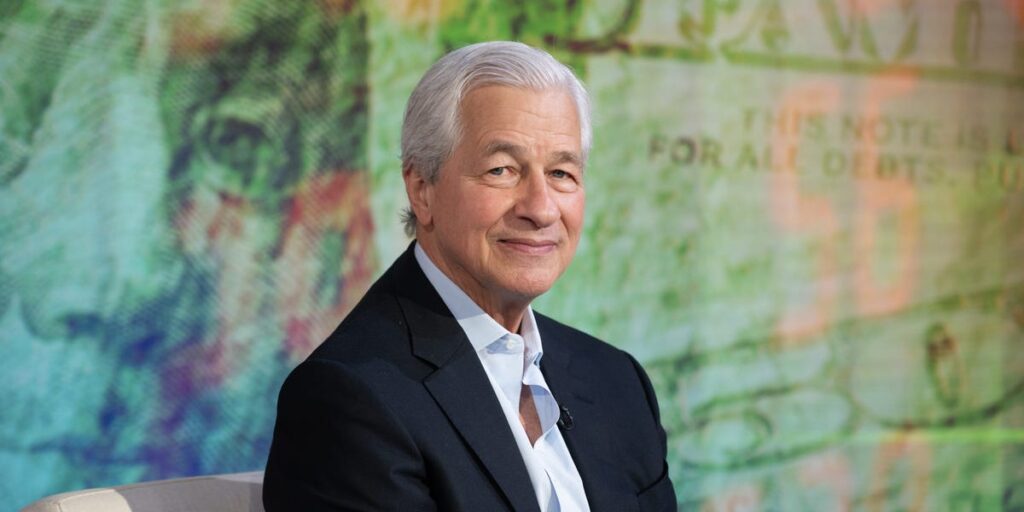

The CEO of America’s largest bank has long been skeptical of the rise of private credit, even as JPMorgan Chase jumps on the nonbank lending bandwagon in an effort to compete.

“I think that people who haven’t been through major downturns are missing the point about what can happen in credit,” Jamie Dimon said at the bank’s investor day in May.

This week, Dimon’s concerns were bolstered by a report issued by Moody’s Analytics, a former advisor to the Treasury Department, and a Securities and Exchange Commission senior economist. The report warned that the growing practice of raising money from institutional investors to make loans may be a “locus of contagion” during a future financial crisis.

The report raised concerns about what it called the industry’s growing “interconnections” across industries from banking to insurance.

“The same institutional investors, say an insurance company or a sovereign wealth fund, might hold stakes in private credit funds, CLOs, and public corporate bonds,” the report said, adding:”If losses occur in one investment, that investor may be forced to liquidate assets elsewhere, propagating stress.”

At a conference last May, Dimon said that there “could be hell to pay” if the private credit sector falters, saying it reminds him a “little bit” of the mortgage industry.

Private credit investors, like Apollo CEO Marc Rowan, have argued that the new model is actually making the financial system safer.

“Jamie is an amazing representative of the banking industry,” Rowan said the day after Dimon’s comments last May, when he was asked about them. “But every dollar that moves out of the banking industry and into the investment marketplace makes the system safer and more resilient and less levered.”

The private credit industry is still much smaller than banking, and does “not yet appear to be systemically important,” the report said, adding that “it could disproportionately amplify a future crisis.”

The report listed regulatory recommendations that could soften the potential impact of a private-credit crisis, such as increased stress-testing of large funds, transparency and data reporting, and limits or guidelines on leverage at certain funds.

In other words: Make private credit funds a bit more like banks.

“The objective is not to stifle the beneficial innovation that private credit provides but to shine a light on its risks and linkages so that a rapidly growing part of corporate finance, and potentially other sectors, does not become a blind spot,” the report said.

[ad_2]

Source link