[ad_1]

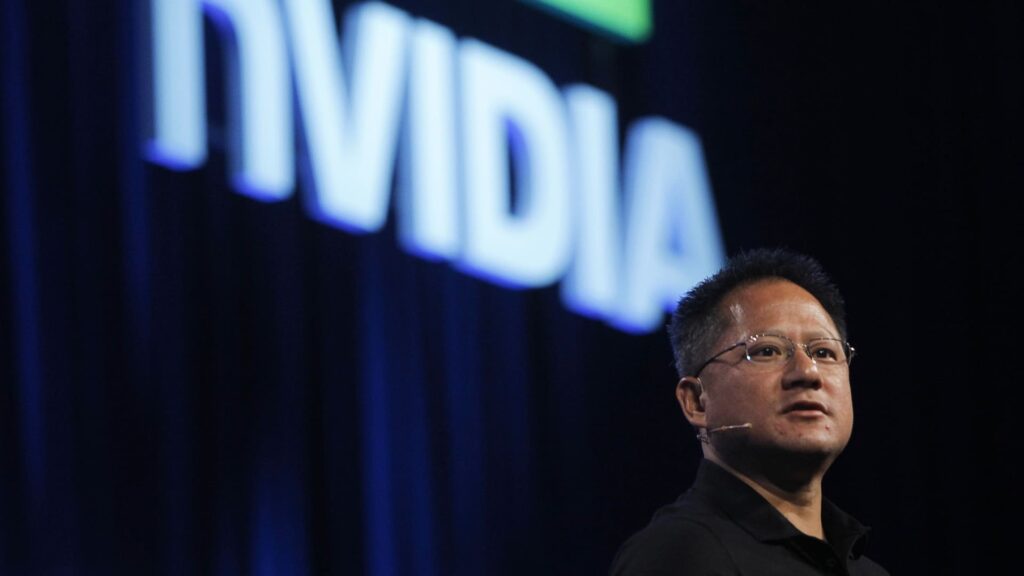

Here are Friday’s biggest calls on Wall Street: Stephens initiates Snowflake as overweight Stephens said Snowflake is best-in-class. “Long-term growth visibility which has traditionally been the replacement of legacy databases is now being augmented as faster product development has launched key new products w/large TAMs that have yet to contribute to the growth rate, in our view.” Evercore ISI upgrades Citizens Financials to outperform from in line Evercore ISI said shares of the banking company are compelling following earnings. “We are upgrading CFG to Outperform from In Line as we expect strengthening B/S [balance sheet] trends, favorable NIM [net interest margin] dynamics, fee income upside, and positive operating leverage to drive steady improvement in CFG’s earnings trajectory and L/T returns.” Mizuho reiterates Micron as buy Mizuho said it sees a slew of positive catalysts and that investors should buy the weakness. “We would be buyers on MU on the pullback…” Bank of America reiterates Alphabet as buy Bank of America raised its price target on Alphabet ahead of earnings on July 23 to $210 per share from $20. “Expecting strong results, above Street for 2Q.” Citi downgrades Barclays to neutral from buy Citi said it sees a more balanced risk/reward. “Barclays shares are +125% since end-2023 and now trade on 0.9x P/TB for a target > 12% RoTE next year. While this target appears feasible (we model ~12%), we believe the risk-reward is now more evenly balanced…” Rosenblatt initiates SentinelOne as buy Rosenblatt said the cyber security company is “significantly undervalued.” “We are initiating coverage on SentinelOne (NYSE: S) with a Buy rating and a $24 Price Target.” Morgan Stanley reiterates Netflix as overweight Morgan Stanley raised its price target on the stock to $1,500 per share from $1,450. “Importantly, newly deployed ad tech appears poised to deliver a roughly doubling of ad revs in ’25. Netflix’s early but growing use of GenAI tools to power content and product innovation further reinforces our bullish view.” Read more. Deutsche Bank reiterates Microsoft as buy Deutsche Bank raised its price target on the stock to $550 per share from $500. ” Microsoft shares have significantly outperformed since the company reported much better-than-expected F3Q Azure results in April and seem well supported heading into what we anticipate will be strong F4Q results on July 30th.” Jefferies upgrades Abbott Labs to buy from hold Jefferies said investors should buy the dip following earnings. “While ABT’s 2Q/guide update was underwhelming, we view the stock rxn as too punitive and are taking advantage of the pullback, upgrading ABT to Buy.” KeyBanc upgrades Materion Corporation to overweight from sector weight KeyBanc said it sees an attractive risk/reward for the engineered materials company. “Following our recent analysis, we are upgrading shares of Materion Corporation (MTRN) to Overweight from Sector Weight with a $112 price target, representing > 20% upside.” Deutsche Bank adds a catalyst call buy on DuPont Deutsche Bank said it is bullish ahead of earnings in early August. “We are adding DuPont as a Catalyst Call Buy as we believe the upcoming Q2 release would be a catalyst for the shares as it will mark DuPont’s last quarterly earnings release prior to the spin-off of its Electronics business (Qnity) on November 1.” JPMorgan reiterates Nvidia as overweight The firm said Nvidia remains a top pick heading into earnings next month. “AI/accelerated compute demand remains strong…best positioned to weather a potential trade/tariff challenging macro environment…13-15% EPS upside to outyear estimates on resumption of China shipments for AMD/ Nvidia. ” JPMorgan reiterates Roku as overweight JPMorgan raised its price target to $100 per share from $85. “We believe Roku is well positioned to deliver a beat/raise qtr, with ad spend largely stable in 2Q and China tariff de-escalation.” BMO upgrades Chipotle to outperform from market perform BMO said comps have begun to accelerate. “We believe CMG is well positioned for accelerating comp growth and improving margin trajectory beginning in 2H25, and view favorably its strong US-heavy store growth that has room to accelerate towards 10% over time.” Evercore ISI reiterates Apple as outperform Evercore ISI said it is sticking with the stock ahead of earnings on July 31. “Finally, AAPL we expect to see strength in June-qtr driven by better iPhone demand though focus will be on services and gross-margins.” Bank of America reiterates Dell as buy The firm raised its price target on the stock to $165 per share from $155. “We expect IT Hardware companies like DELL to benefit from the growth of enterprise /sovereign AI over the next decade.” Deutsche Bank reiterates Tesla as buy Deutsche Bank said it is sticking with the stock heading into earnings on July 23. “Long term, our view continues to be that Tesla is well positioned as a technology platform to leverage end-to-end AI into a leading position in autonomous driving and humanoid robotics.”

[ad_2]

Source link