[ad_1]

Elon Musk is right to worry about America’s debt problem — and bitcoin is no more valuable than a flower, author Nassim Nicholas Taleb said in a wide-ranging interview with Business Insider.

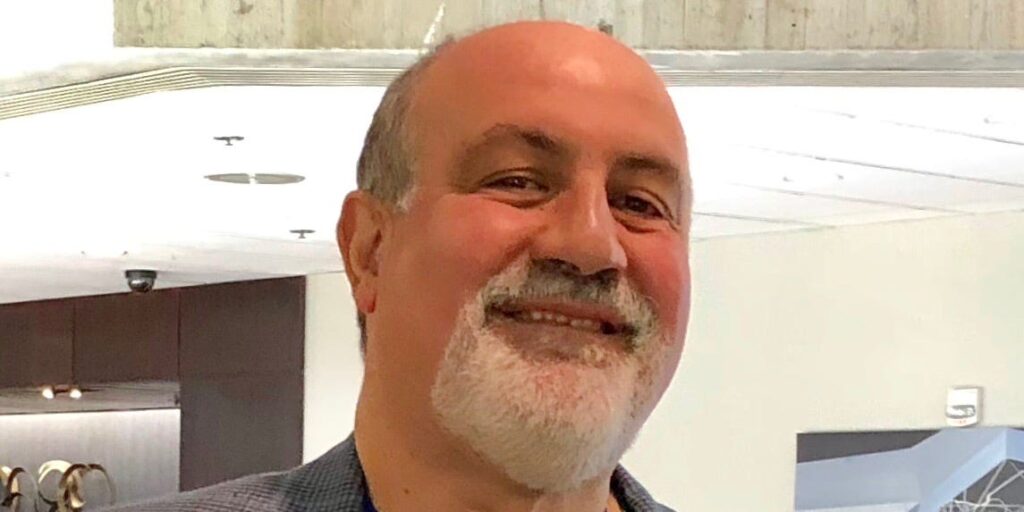

Taleb popularized the term “Black Swan” to refer to rare, extreme, unexpected events that are seen as less surprising in hindsight. He’s a distinguished scientific advisor to Universa Investments, a “Black Swan” hedge fund that manages over $20 billion in client assets and specializes in hedging against “tail risks” — rare and extreme market events.

Taleb spoke about Donald Trump’s tariff fights, Musk’s deficit angst, declining trust in the US dollar, and why he remains deeply skeptical of bitcoin even as it rises to new highs.

Debt spiral

Taleb told BI there’s “plenty of risk” but it’s “not necessarily linked to things you read in the paper every day.” He singled out the US federal debt, which has more than tripled to around $37 trillion within the past 25 years, and is set to rise further with Trump’s “big, beautiful bill” forecast to add another $3 trillion at least over the next decade.

The US government paid $881 billion of interest on its debt in fiscal 2024 — more than the $865 billion it spent on Medicare or its $850 billion outlay on defense, per the Congressional Budget Office.

“We have enormously burdenous debt,” Taleb said. “Elon’s quite justified to be upset with the two-party system,” he added, nodding to the Tesla CEO and ex-DOGE boss who formed an “America Party” after falling out with Trump over his bill.

Concerns about America’s debt, and other factors, including Trump’s tariffs, have fueled a roughly 10% decline in the dollar against a basket of global currencies this year.

Taleb said the dollar “ceased to be the reserve currency” when the US said it would freeze assets with ties to the Russian government following the country’s full-scale invasion of Ukraine in February 2022.

Related stories

Many people were “uncomfortable” at what they perceived to be an overreach, Taleb said, adding this prompted several central banks to swap dollars for gold, contributing to a broader de-dollarization trend.

Taleb added that Trump was “antagonizing” US trade partners with import taxes. He told BI that he has “nothing against tariffs in principle,” but the president’s use of them to strike deals is “not very coherent and spooks the rest of the world.”

Deteriorating trust in the dollar and America is “bad because we have to borrow and we don’t want a debt crisis,” Taleb said, pointing to soaring interest costs that make the debt a “source of fragility.”

Crypto critique

Taleb has been a vocal critic of bitcoin for years, calling it a “cult,” a “tumor,” and a “magnet for imbeciles.”

Speaking as it continued to hit record highs of more than $120,000, Taleb told BI that bitcoin was an “electronic tulip” — a reference to the Dutch Tulip Bubble in the 17th century that saw a speculative frenzy lift the price of tulips to eye-watering levels.

Taleb again said that bitcoin “cannot be a currency,” highlighting its volatility and crypto fans’ desire for it to keep rising, when stability is core to being a reliable medium of exchange.

He also questioned how the coin could be widely adopted when many governments would be loath to undermine their currencies by supporting it.

[ad_2]

Source link