[ad_1]

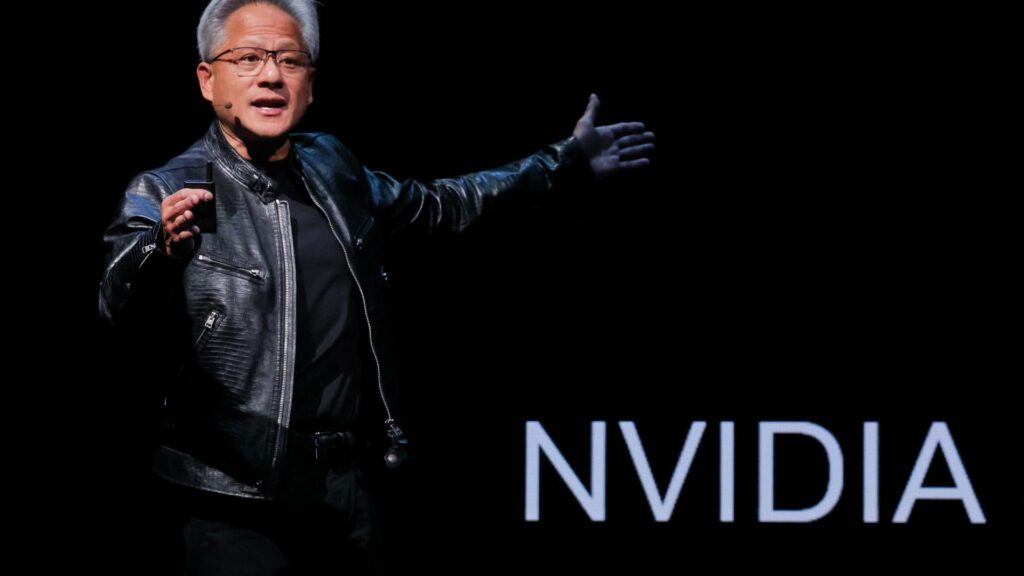

Here are Tuesday’s biggest calls on Wall Street: Goldman Sachs initiates Revolution Medicine as buy Goldman said the oncology company is well positioned. “We initiate coverage on Revolution Medicines (RVMD) with a Buy rating and 12-month price target of $65.” Goldman Sachs initiates Alkermes as buy Goldman said it likes the biopharma company’s pipeline of products. “We initiate coverage on Alkermes (ALKS) with a Buy rating and 12-month PT of $43. ALKS is an established commercial company whose mature portfolio of neuropsych assets.” Barclays initiates Ralliant as overweight Barclays said the precision tech company has an “undemanding” valuation. “RAL in our view represents a rare breed in MI [multi industry] nowadays – a pure play, high-quality asset with depressed cycle dynamics (for sales and margins) and a valuation that looks undemanding.” Oppenheimer reiterates Nvidia and Broadcom as outperform Oppenheimer raised its price target on Nvidia to $200 per share from $175 and on Broadcom to $305 per share from $265. “Our top picks are NVDA , AVGO, MRVL, and MPWR.” JPMorgan downgrades SolarEdge to neutral from overweight JPMorgan downgraded the stock mainly on valuation. “We are downgrading SEDG to Neutral from Overweight, given the stock’s significant outperformance recently,…” Deutsche Bank initiates Jazz Pharmaceuticals as buy Deutsche said in its initiation of Jazz that it’s a “growth story w/ diversified commercial portfolio.” “At present, the company’s focus is on developing and commercializing more innovative biopharma assets, though the stock continues to trade at depressed multiples relative to commercial-stage peers.” Rosenblatt initiates Gitlab as buy Rosenblatt said the software company is well positioned for growth and share gains. “In our view, the growth in and complexity of modern cloud and emerging GenAI applications and the upsell opportunity for GitLab provide significant runway for growth.” Goldman Sachs initiates Nutanix as buy Goldman said shares of the software company have more room to run. “We initiate on Nutanix with a Buy rating and $95 Price Target, viewing it as a key modernization play for enterprises navigating legacy infrastructure transitions.” Evercore ISI reiterates Tesla as in line The firm said it’s staying cautious on Tesla shares. “We believe the stock, today, is increasingly both NOISE & SIGNAL based on: 1) Unabated negative revisions, 2) Disappointing AV rollout, 3) Increasingly divisive political posting, & 4) Technicals on edge.” JPMorgan upgrades California Resources to overweight from neutral JPMorgan said the energy company is undervalued. “We are upgrading CRC to Overweight (from Neutral) as we believe the stock is undervalued on a sum-of-the-parts basis.” Wells Fargo reiterates Microsoft as overweight Wells raised its price target on Microsoft to $600 per share from $585. “Recent field work suggests no slowdown in demand for MSFT’s AI solutions, bolstering our confidence in the 4Q & FY26 setup ahead. Further, recent cost actions help offset growing deprec burden, enabling DD%+ EPS growth next yr.” Read more . Morgan Stanley downgrades Freeport-McMoRan to equal weight from overweight Morgan Stanley said it sees “few positive catalysts” right now for the metals and mining company. “We still see some upside i n FCX shares as the company benefits from comparatively high exposure to COMEX copper prices and a strong gold outlook, but the risk-reward now looks less compelling, with few positive catalysts in the near term.” Morgan Stanley downgrades Ameriprise Financial to underweight from equal weight The firm downgraded the financial services company mainly on valuation. “Slower growth at AMP rel to peers drives our downgrade to UW (from EW). Bank of America reiterates Netflix as buy Bank of America said it’s sticking with Netflix shares ahead of earnings later this week. “We anticipate that Netflix’s (NFLX) 2Q25 results will be at least in line with guidance on key metrics including revenue, OI [operating income] and EPS.” Bank of America reiterates Meta as buy The firm raised its price target on the stock to $775 per share from $765. ” Meta is our 2025 top Online ad stock as best-positioned company to benefit from AI-driven advertising share gains and upside.” Bank of America reiterates Amazon as buy The firm said it believes Amazon’s Prime Day was a success. “Also, we think initiatives like improved inventory placement & robotics likely drove fast shipping speeds (we received our orders in 1 to 2 days) and strong consumer satisfaction.” Jefferies downgrades DoorDash to hold from buy Jefferies downgraded the stock on valuation. “With the stock up 45% YTD and valuation at a 120% premium to Internet, we downgrade to Hold given DASH’s strong execution and growth algorithm appear fully reflected.” Evercore ISI downgrades Southwest to in line from outperform Evercore downgraded the stock on valuation. “Our rating on LUV shares is reduced to In-Line from Outperform on YTD outperformance and relative valuation expansion.” Bank of America upgrades National Fuel to buy from underperform Bank of America said it sees an attractive entry point for the diversified energy company. “We are double upgrading NFG to Buy and raising our PO to $107.” Susquehanna initiates Ryder System as positive The firm said the trucking company is poised for a rerating. “We believe Ryder has a clear path to strong earnings growth from 1) Cyclical Inflection; 2) Stagflationary Truck Environment; and 3) Capital Deployment from Strong FCF, even without a rerating.” Cantor Fitzgerald initiates Oklo as overweight Cantor said the nuclear power company is a market leader. ” Oklo is paving the way for the world to safely transition to a nuclear powered future.” Truist initiates Globe Life as buy Truist said the financial services company is a “durable long-term performer at a discount.” “In our view, investors can now purchase GL shares at a discount valuation because of a misguided short report and, to a lesser extent, short-term volatility in medical utilization.” Monness Crespi Hardt & Co downgrades American Express to neutral from buy Monness downgraded the stock mainly on valuation. “We are downgrading Amex to a Neutral – following a 45% runup since upgrading – considering shares trade at the 93rd %ile of NTM EPS multiple + math required to underwrite a higher price.”

[ad_2]

Source link