[ad_1]

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

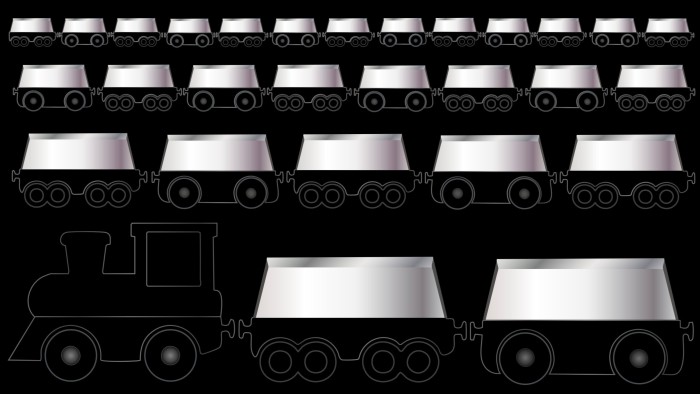

Back in 1857, the Bank of Austria loaded 10mn ounces of silver on to a train and dispatched it to Hamburg. The reason? The city’s banks were about to collapse, having run out of reserves.

So Austria sent that “silver train” to provide liquidity. And 30 years later the French central bank did the same with a boat of gold, during Britain’s Barings crisis.

Might such aid be needed again, in a 21st-century dollar form? It is a question now being quietly mulled among European and Asian central bankers, in relation to the once-arcane issue of central bank dollar swap lines. Investors should pay close attention.

The reason is that these swap lines have been considered a core pillar of the global financial system in recent decades, since they have enabled major Asian and European central banks to get dollars from the US Federal Reserve in a crisis. This is crucially important because in times of market stress there is usually a “dash for cash” — that is, a scramble for dollars, given the greenback’s role as a reserve currency.

However, non-US entities cannot print those dollars, and so may not be able to meet demand. Thus during the 2008 financial crisis, the Fed activated some $583bn in swap lines for non-US central banks, to enable dollars to flow to commercial banks.

It did the same during the Eurozone crisis and then provided $450bn during the Covid pandemic in 2020 — a move that quelled financial contagion, according to the Richmond Fed.

But doubts are now creeping in about the reliability of that safety net. After all, the administration of US President Donald Trump seems determined to reset the global financial and economic order and to put American interests first. JD Vance, the vice-president, has observed that he “just hate[s] bailing Europe out”.

Deals with allies, in other words, no longer seem sacred. Just look at this week’s revelation that the Pentagon is reviewing its submarine pact with the UK and Australia.

Fed officials, for their part, vehemently deny that the dollar swaps system could echo this submarine tale. Indeed Jay Powell, Fed chair, stressed its merits during a speech in Chicago in April.

But what worries some outside the US is what might happen when Powell leaves in 2026. The Fed currently has permanent dollar swap facilities with five central banks (in the Eurozone, Switzerland, Japan, Britain and Canada) and it previously created temporary facilities for nine others, including Australia, Brazil and Denmark, that have expired.

It is unclear whether those latter facilities would be restored in a crunch — and, if so, at what “price”. If the Fed offered swaps to the Danish central bank, say, would Trump demand concessions on Greenland? It is also unclear whether Washington might attach conditions to the permanent swap lines. After all, Scott Bessent, Treasury secretary, views finance, military, trade and tech issues as being deeply entwined.

Then there is Congress, which has ultimate authority over the Fed. After the 2008 crisis, there was some bipartisan congressional criticism of the swaps line, which Fed officials mostly quelled by noting that a global financial panic would have hurt America. But this criticism could easily return, particularly given Trump’s protectionist and populist instincts.

Hence the need for Europe to ponder that 1857 “silver train”. Last month Luis de Guindos, European Central Bank vice-president, insisted that the ECB remained confident the Fed would retain the swap lines. But it recently emerged that the ECB has asked its banks to report vulnerabilities around their dollar exposures.

And an article published by the influential CEPR think-tank has now called for non-US central banks to create a mutual pact to prepare for a worst-case scenario. The idea would be for 14 central banks to use their estimated $1.9tn dollar holdings to extend liquidity to each other, if the Fed retreated, in co-ordination with the Bank for International Settlements.

No central banker has publicly backed this idea. But some tell me that many contingency plans are being discussed. And in the meantime, they are quietly taking other defensive steps, such as raising their purchases of gold, and, in the case of smaller countries, cutting swap deals with China.

“There is debate about the Kindleberger trap,” one tells me, referring to the economist Charles Kindleberger’s warning that turbulence erupts when a dominant geopolitical power loses the ability or desire to support a reserve currency, without its ascendant rival stepping into the breach. (This is what happened in the interwar years before sterling was replaced by the dollar.)

We are emphatically not at such a Kindleberger moment now — and we must hope it never comes. But the key point is this: unless the White House clearly supports Powell’s comments about the need to preserve dollar swap lines, unease will grow. So let us all trust that Bessent, as a financial history buff, recognises this, and acts. If not the price of gold will keep on rising.

gillian.tett@ft.com

[ad_2]

Source link