[ad_1]

Apple’s stock price has been bleeding this year, and it looks unlikely that the company’s big “Liquid Glass” design overhaul will be anything more than a Band-Aid.

Wall Street was largely unimpressed by the announcements at Apple’s Worldwide Developers Conference on Monday, where the company showed off its glass-like software design coming this fall to Apple’s gadget lineup.

While the sleek look has its fair share of early fans, the elephant in the room was Apple’s continued challenges and delays in catching up in the AI race.

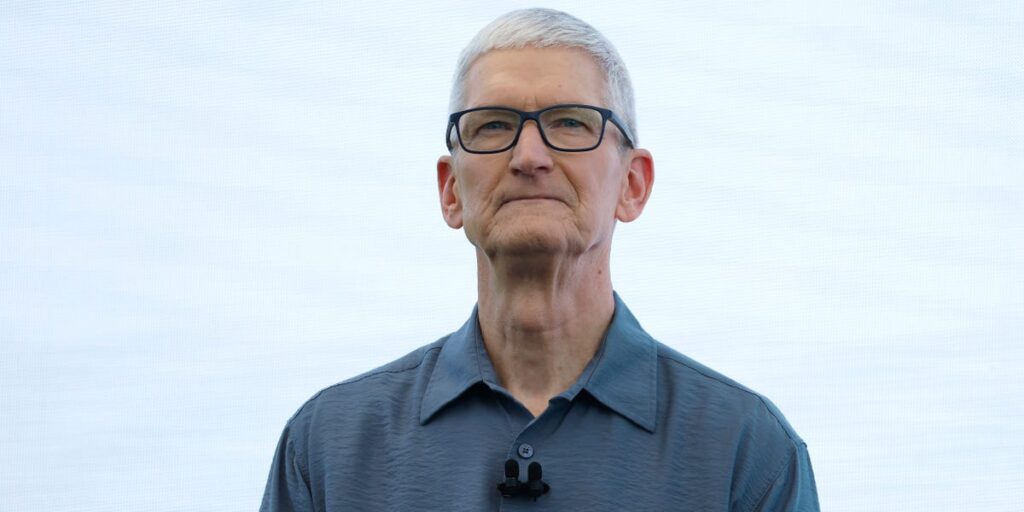

Apple is known to take a slow-and-steady approach — “Not first, but best,” as CEO Tim Cook likes to say — however, the jury’s still out on whether the company’s AI features, collectively called Apple Intelligence, can drive iPhone upgrades in a meaningful way.

“Liquid Glass” was the main focus of Apple’s keynote on Monday, while Siri, which is undergoing a much-needed overhaul that’s been significantly delayed, barely got any screentime. (And when it did get mentioned, the stock took a dip shortly after, shedding $75 billion from Apple’s market cap.)

Apple

On the one hand, Apple might have learned its lesson from last year’s WWDC, where it excitedly showed off the overhauled Siri and months later ran ads it later pulled featuring unreleased AI features after saying it needed “more time.”

So far, Wall Street analysts said Monday’s announcements suggest a “transitional” and more “incremental” year for Apple, with no “killer” AI feature in sight.

A more powerful Siri could be the feature that sparks the iPhone upgrade surge that Apple needs, Edward Jones analyst David Heger said in a note.

“The silence surrounding Siri was deafening; the topic was swiftly brushed aside to some indeterminate time next year,” Forrester’s Dipanjan Chatterjee told Business Insider.

The updates at WWDC were “incremental” and “unlikely to drive iPhone demand,” analysts at UBS said in a note. As a result, the analysts said they believe “consensus iPhone revenue estimates over the next 4 quarters are too optimistic.”

Some analysts saw potential in some of Apple’s newly announced AI-powered features that bring quality of life improvements, such as call screening and live translating.

“Apple’s artificial intelligence rollout has been protracted and still lacks better Siri integration, but we believe AI is helping Apple develop new and convenient features more quickly,” William Kerwin, tech analyst at Morningstar, said in a note following WWDC.

The Holy Grail for Apple would be a combination of must-have AI features coupled with a new iPhone form factor that spurs a so-called “super cycle” of upgrades in the fall when the iPhone 17 comes out.

While it sounds like Apple has a slimmer iPhone Air in the works, it’s still working to crack the code on AI features — leaving analysts doubtful of any super-cycle this fall.

“We were not expecting much from the annual WWDC keynote, but were still slightly disappointed at the content and features announced today,” Barclays analysts wrote. “We view changes to all device Operating Systems and Apple Intelligence as incremental, and not enough to drive any upgrade cycles.”

[ad_2]

Source link