[ad_1]

No one wants to own cable networks anymore.

Would you like to buy some?

That is the pitch that Warner Bros. Discovery is making to Wall Street now that it has announced it’s splitting itself into two companies: One will own Warners’ movie and television studio and the HBO Max streaming service; the other — which it’s calling its “global networks” unit — will own a bunch of cable TV networks including CNN, TNT, Discovery and the Food Network.

If that sounds familiar, it’s for two reasons:

WBD has been contemplating this for a long time.

Last summer, it floated the same idea but didn’t go forward with it. In December, it all but said it was going to do this, after all, by splitting itself up internally. Now it’s doing it for real.

Comcast is doing the same thing.

Last October, Comcast said it would bundle almost all of its cable channels into a separate company (which it’s calling Versant, for some reason) and hang onto its movie and TV studio and its Peacock streaming service.

Like Comcast, WBD insists that no, really, it’s splitting off its cable TV networks so they can grow and thrive on their own, and you’d be lucky to buy a piece of them.

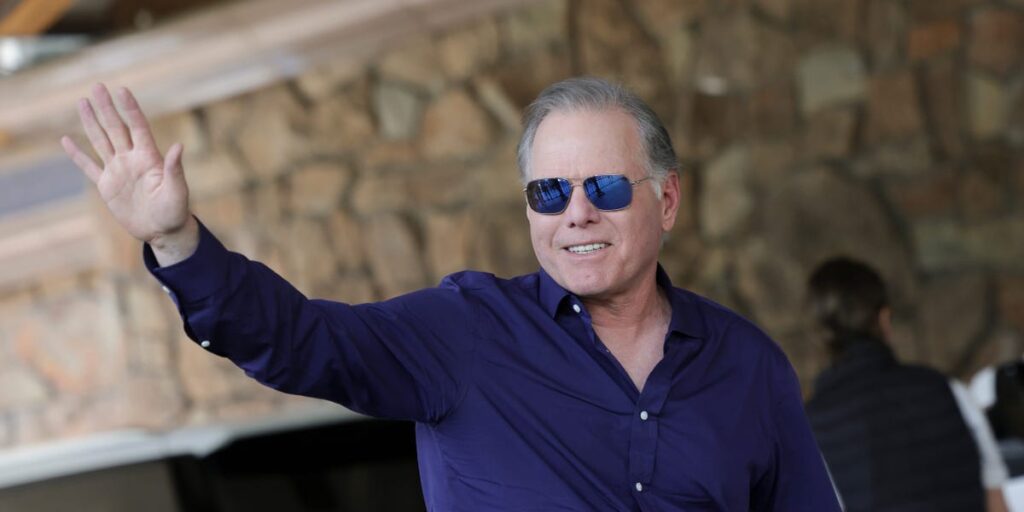

“The global networks business is a real business,” WBD CEO David Zaslav said on the company’s investor call Monday morning.

That is definitely true, since those cable networks continue to generate profits. It’s also something you don’t normally feel compelled to say when you’re selling something people want to buy.

Because the big picture here is that both WBD and Comcast have concluded what investors — and people who watch things on TV — have concluded long ago: The cable TV business is a shrinking business, as more and more people cut the cord or simply never sign up for one. And the people who continue to watch cable TV are getting older and smaller in number.

The WBD split will generate all kinds of questions to ponder. Some of them are technical: How will WBD’s $35 billion in debt be split up between the companies? How will the split companies approach future distribution deals with the likes of Comcast and Charter? How quickly could Comcast and WBD combine their two cable groups into one bigger cable group? Will the split help WBD’s stock (it’s up Monday — but note that Comcast also spiked when it announced its deal last fall, and has fallen some 20% since)?

Some questions the WBD split can generate may also matter to people who don’t care about corporate finance. Such as: What does this mean for the future of CNN — the news channel that’s struggling to find a lane in a loud and crowded media environment, but whose brand still has lots of potential value?

But the big takeaway is the obvious takeaway: The people who run the biggest collections of cable TV channels in the country would like someone else to own them. Because every quarter, the number of people who watch those channels and pay for those channels gets smaller.

Like I said late last year: These are garage sales. Maybe someone will want to own shrinking businesses that still throw off lots of cash (paging private equity). But the people who have them now think they’d be better off without them. Buyer beware.

[ad_2]

Source link