[ad_1]

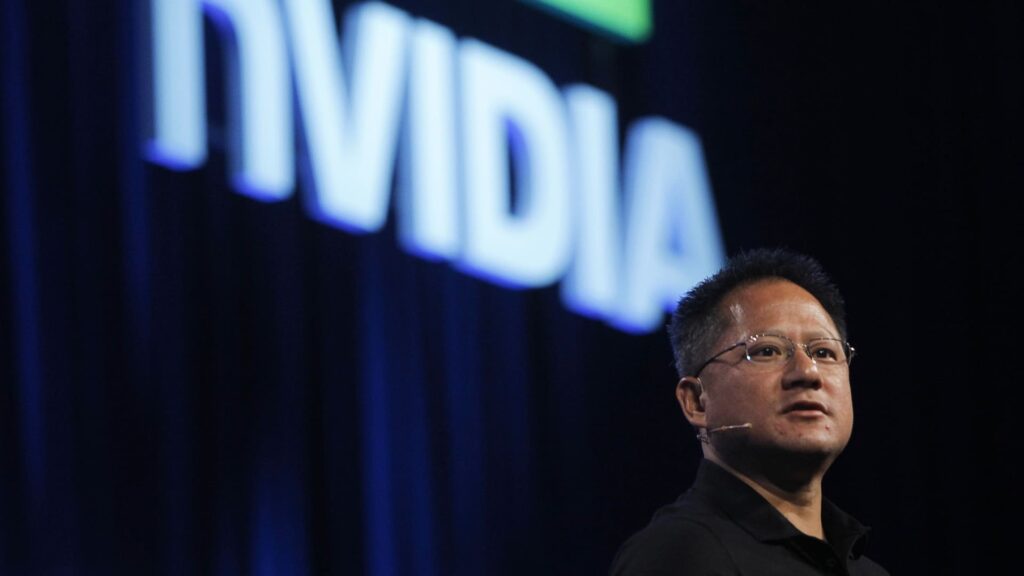

Bank of America thinks there’s a slate of stocks worth snapping up and still have room to run. The firm said buy-rated companies like Nvidia have plenty of upside heading into summer. Other names include Philip Morris, Boot Barn, Amazon and Netflix . Netflix The streaming giant is firing on all cylinders and well positioned for growth, according to the firm. Analyst Jessica Reif Ehrlich recently raised her price target on the stock to $1,490 per share from $1,175, reflecting on her bullish thesis. “Year-to-date, Netflix has been a top performer in our coverage driven by: sustained earnings momentum, positive subscriber trends and a defensive rotation related to tariffs,” she wrote. There’s more to come as the company ramps up its advertising technology ,which should help the bottom line, the analyst said. “We continue to view Netflix as well positioned given the company’s unmatched scale in streaming, further runway for subscriber growth, significant opportunities in advertising and sports/live and continued earnings and [free cash flow] growth,” Reif Ehrlich added. The stock is up 39% this year. Amazon Analyst Justin Post recently lifted his price target on the e-commerce giant to $248 per share from $230. The firm said that robotics are poised to play a key role in how Amazon operates and this should increase the company’s already “competitive moats.” Post said the use of drones along with robotics will help margins, as well further reduce delivery times. “Going forward, we expect Amazon to leverage robots to: 1) reduce labor dependency; 2) increase order accuracy; and 3) improve warehouse efficiency, driving material cost savings,” he added. Meanwhile shares are up more than 15% over the past 12 months, and they have room for further growth, Post said. “We think Amazon is well positioned to capitalize on the global growth of eCommerce and other secular trends such as cloud computing, online advertising and connected devices,” he added. Boot Barn The Western-themed footwear company is firing on all cylinders, according to Bank of America. Analyst Christopher Nardone recently raised his price target on the stock to $192 per share from $173 citing a slew of positive catalysts ahead. “We are encouraged that the acceleration in comp trends has been broad-based across major merchandise categories and geographies,” he wrote. The firm said the company is a multi-year growth story with plenty more room to run. In addition, the pricing environment remains very friendly and could lead to share gains, Nardone added. “With larger scale comes better pricing, better selection, more exclusive brands, and better customer service,” he said. The stock is up 8% this year. Netflix “Year-to-date, Netflix has been a top performer in our coverage driven by: sustained earnings momentum, positive subscriber trends and a defensive rotation related to tariffs. … We continue to view Netflix as well positioned given the company’s unmatched scale in streaming, further runway for subscriber growth, significant opportunities in advertising and sports/live and continued earnings and FCF growth.” Amazon “Going forward, we expect Amazon to leverage robots to: 1) reduce labor dependency; 2) increase order accuracy; and 3) improve warehouse efficiency, driving material cost savings. … Robotics could increase AMZN’s competitive moats. … We think Amazon is well positioned to capitalize on the global growth of eCommerce and other secular trends such as cloud computing, online advertising and connected devices.” Nvidia “AI demand/visibility remain strong, maintain Buy, top pick. … We maintain Buy, a top sector pick with a $180 PO as we believe NVDA remains best positioned to benefit from the ongoing AI tide, supported by a multi-year lead in performance (AI scaling), pipeline, incumbency, scale, and developer support.” Boot Barn “We are encouraged that the acceleration in comp trends has been broad-based across major merchandise categories and geographies. This gives us confidence BOOT isn’t overearning in a specific geography or category. … With larger scale comes better pricing, better selection, more exclusive brands, and better customer service.” Philip Morris “PM has been a top performer in the US market this year, led by execution, improving profitability in smoke-free, ZYN/IQOS volumes and continued contribution from combustibles to support SF [smoke free] growth. Its lack of exposure to China, tariff swings and its defensive nature is also attractive. As we see PM as well positioned to navigate external volatility, we boost our PO by $18 to $200.”

[ad_2]

Source link