[ad_1]

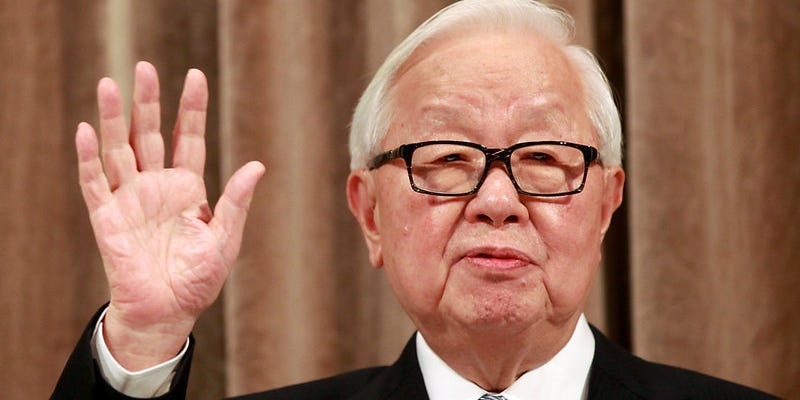

Morris Chang is a legend in the semiconductor business.

He created the world’s largest chipmaker, Taiwan Semiconductor Manufacturing Co. (TSMC), which works with companies such as Apple, Nvidia, and Qualcomm and has seen swelling demand for its products amid the AI boom.

Now 94 years old, Chang has a net worth of $5.1 billion, according to Forbes.

He spent two decades at Texas Instruments before starting TSMC at the age of 55.

He rarely gives interviews but has shared some valuable business and leadership lessons from his successful career over the years.

On getting promotions

Chang was on the fast track at Texas Instruments and quickly advanced in the company. In a 2007 interview for industry association SEMI, he said that the key to his success with promotions there was that he “accomplished something significant” in each of his roles, including dramatically increasing production yield.

On taking risks

Chang worked in the US for decades before starting TSMC in Taiwan. He said in 2007 that he made the move, despite knowing it’d mean lower pay, because “it was so new, and appeared to be so challenging.”

“You need to follow your interests, not where you think the big money is,” he said. “Because, obviously, back in 1985, the big money was thought to be in financial venture capital, or maybe even continuing to manage a company in the U.S., but I felt that the Taiwan opportunity appealed to me from the interest point of view.”

He added, “As it turned out, when you don’t chase money, money comes to you.

On learning

Chang says learning by doing for manufacturers relies on centering production in one place.

“It works, the learning curve, the experience curve, it works only when you have a common location,” Chang said at a talk at MIT in 2023. “Learning is local.”

Related stories

The learning curve, or experience curve, which he’s frequently touted in his career, is the idea that as you make more of something, the cost per unit goes down; in other words, as you become more experienced at something, you also become more efficient at it.

On workforce management

Chang shared a behind-the-scenes account of the decision-making that went into Texas Instruments’ layoffs of thousands of workers decades ago.

He said he was the only person involved in the discussions who rejected the idea of using performance reviews to determine whose jobs would be cut.

“People would not respect us if we lay off by performance,” he said on an episode of the “Acquired” podcast in January 2025. “It’s very subjective.”

“The separation expense is usually half a year, and it takes at least half a year to train a person, so if you need people back within a year, you shouldn’t lay off,” he added.

On customer service

Chang believes TSMC’s reputation for quality customer service was a factor in its prevailing over Intel for an iPhone contract with Apple.

“We have learned to respond to every request. Some of them were crazy, some of them were irrational — but we responded to each request courteously. Which we do,” he said on in the same episode of the “Acquired” podcast.

On knowing when to leave

Chang said that he left Texas Instruments earlier in his career without having another job offer lined up because he felt he’d “been put out to pasture” there.

“I felt sure that I would still continue to have a job, in fact even a job with a good title, but my hope of further advancement at TI was gone,” he said. “Actually, there was only one step further, it was the CEO, you know, and I decided that there was no hope of that, and besides, I wasn’t doing anything that interested me very much anymore.”

The decision, as time has shown, was a key part of his success story.

[ad_2]

Source link